Spencer Platt/Getty Photos Information

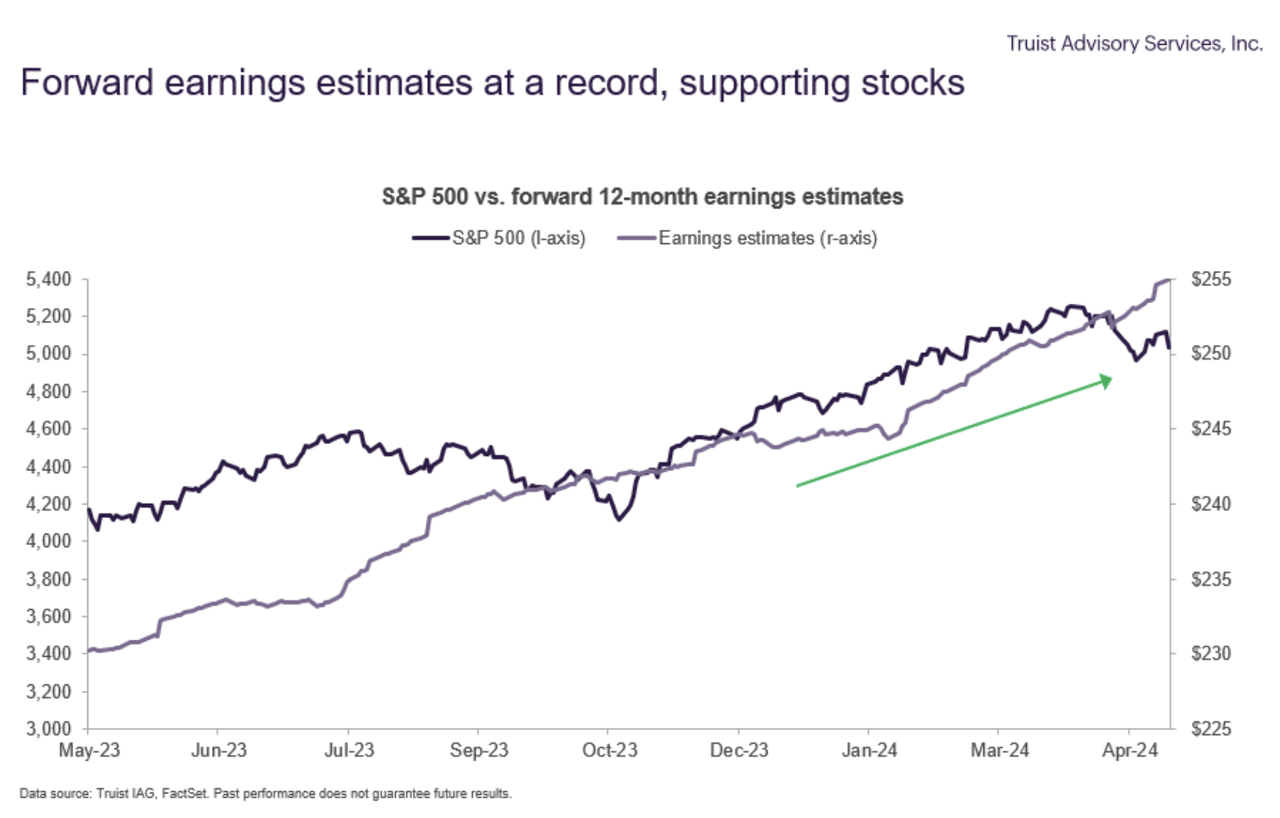

April’s bruising selloff in shares doesn’t seem to mark a significant shift available in the market’s total pattern, in keeping with Truist Advisory Companies, which sees earnings-growth potential among the many supportive pillars for equities over the subsequent 12 months.

As April got here to an in depth, the agency upgraded equities to a extra enticing view. The S&P 500 (SP500) (VOO)(IVV) fell 4.2% final month, the first month-to-month decline since October.

“In our view, what we’ve seen over the previous month has been extra of a reset of an prolonged market versus a basic shift,” Keith Lerner, co-chief funding officer at Truist Advisory Companies, mentioned in a Friday word.

After a multi-month string of features, shares in April have been susceptible to a pullback, Lerner mentioned. Equities have been stung by rising Treasury yields (US2Y)(US10Y) with upside inflation surprises a hurdle to Federal Reserve beginning fee cuts.

Friday’s profitable session left the S&P 500 up 1.8% for the primary three days of Might.

“Shares ought to stay supported by a resilient financial system, document ahead earnings estimates, and optimistic technical developments,” Lerner mentioned. “And on a internet foundation, we see extra upside than draw back potential for equities over the subsequent 12 months.”

There’s “sturdy help” for the S&P 500 between 4700 to 4850, the strategist mentioned. The S&P 500 ended Friday at 5,128. “[Based] on the standard pullbacks since 2009, draw back must be considerably restricted relative to the latest lows,” he mentioned.

Truist downgraded its money place by one notch in late April and upgraded bond length to a extra enticing view given increased charges. The spike up in bond yields in 2024 as costs fall has created a extra enticing entry level for core fixed-income buyers, Lerner mentioned.

Amongst large-cap ETFs, the SPDR S&P 500 ETF Belief (SPY) was up 7.5% YTD, the Vanguard Complete Inventory Market ETF (VTI) has risen ~7% and the Invesco QQQ Belief (QQQ) was picked up ~6%.