Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.As we speak. The monetary and market data supplied on U.As we speak is meant for informational functions solely. U.As we speak isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary consultants earlier than making any funding selections. We consider that each one content material is correct as of the date of publication, however sure presents talked about might now not be accessible.

Justin Solar, the famend crypto entrepreneur and founding father of Tron, not too long ago made a major transfer on the crypto market, prompting hypothesis and intrigue among the many neighborhood.

In line with studies from Lookonchain, citing information from Arkham Intelligence, Solar withdrew a staggering $196 million value of USDT from Huobi and deposited it into Binance. The suddenness and scale of this switch have left many within the business questioning about Solar’s subsequent strategic transfer.

For these unfamiliar with Justin Solar, he’s a notable determine within the cryptocurrency area, recognized for founding Tron, a blockchain-based platform looking for to decentralize the web. Solar’s affect extends past Tron, as he’s actively concerned in numerous crypto ventures and initiatives.

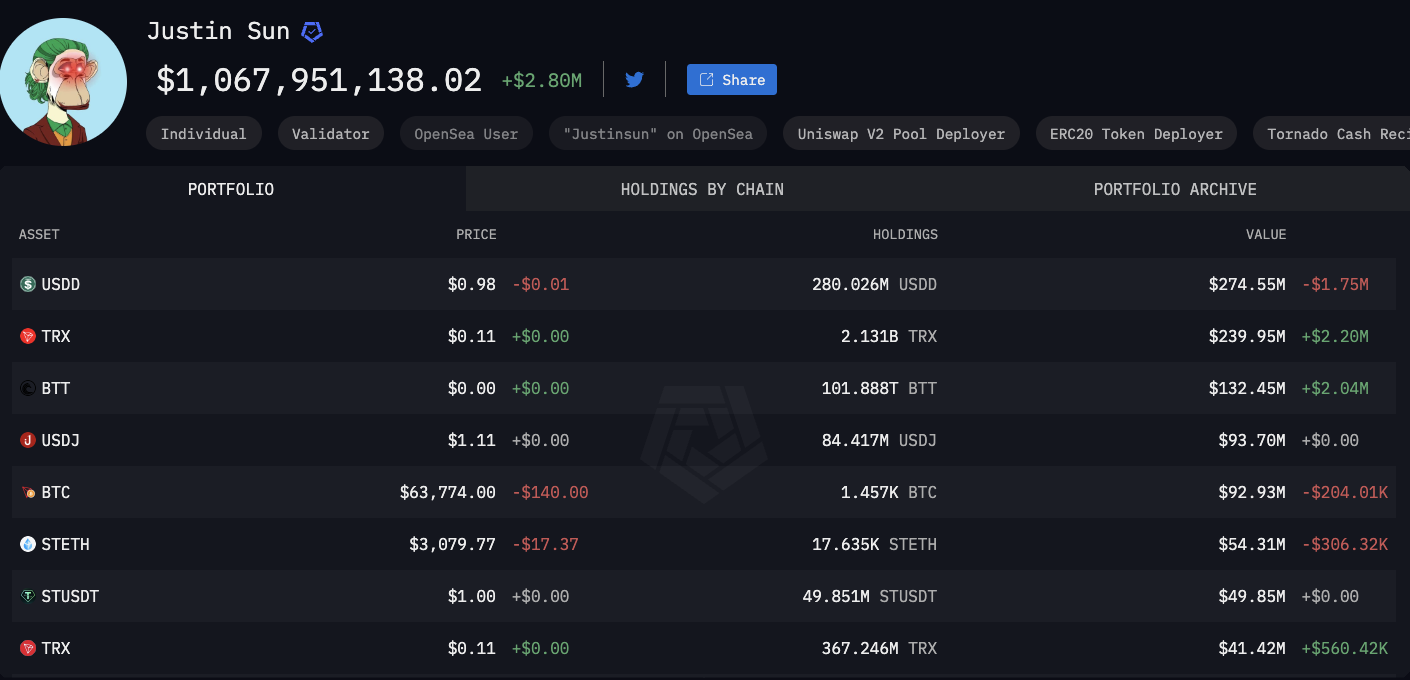

Analyzing Solar’s present crypto holdings offers some perception into his potential motives. Knowledge from Arkham reveals that Solar at present holds over $1 billion in belongings throughout numerous wallets related to him. Amongst these holdings, the biggest share includes 280.026 million USDD, an algorithmic stablecoin, adopted by tokens from the Tron ecosystem, comparable to TRX and BTT.

The largest place that differs from the others in Solar’s portfolio is Shiba Inu (SHIB), the place the entrepreneur has as a lot as 472.094 billion SHIB, equal to $10.59 million.

Market stays unpredictable

Solar’s switch of almost $200 million to Binance comes amid a risky interval within the crypto market. Regardless of experiencing a short downturn, marked by a $80 billion loss in whole capitalization, the market has proven resilience, with patrons stepping in to stabilize costs. Bitcoin’s worth at present stands at $63,500, with market individuals eagerly anticipating what’s subsequent.

Whereas Bitcoin’s trajectory stays unsure, altcoins are having fun with a optimistic development. The TOTAL 2 index, excluding Bitcoin’s market capitalization, has elevated by 0.41% right this moment, reaching the numerous milestone of $1 trillion.