Picture supply: Rolls-Royce Holdings plc

Yesterday (27 February), Rolls-Royce (LSE: RR.) unveiled its full-year earnings for 2024, and the outcomes have been nothing in need of spectacular. The British aerospace titan not solely soared previous revenue expectations but additionally introduced a profitable plan for rewarding shareholders.

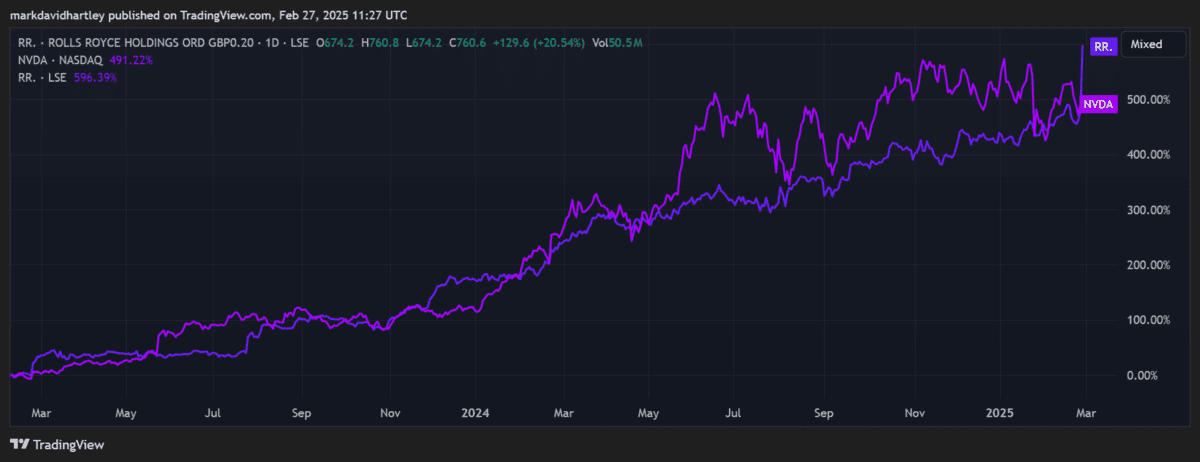

The inventory surged 18% on the information, bringing its year-to-date (YTD) features as much as 28%. It’s now even outperformed Nvidia over the previous two years.

The earnings report has despatched ripples by means of the UK market, bolstering the aerospace sector and contributing to a 0.1% uptick within the FTSE 100 index.

Full-year 2024 outcomes

In 2024, Rolls’ underlying working income rose a outstanding 55%, reaching £2.5bn, and gross sales soared by 15% to £17.8bn. The expansion was fueled by a resurgence in air journey and heightened protection spending amid international geopolitical shifts.

However the information that critically despatched buyers into an eagerness was the reinstating of dividends. Initially, it plans £500m in funds supported by the launch of a £1bn share buyback programme. Dividends will likely be paid at 6p per share initially, equating to a 1% yield.

This marks the primary dividend distribution for the reason that pandemic, solidifying an simple monetary restoration. CEO Tufan Erginbilgiç as soon as once more emphasised the significance of rewarding shareholders to draw future investments.

Extra progress coming?

Below the affect of Erginbilgiç, who took the helm in 2023, Rolls has sharpened its deal with monetary efficiency, implementing cost-saving measures and renegotiating contracts to spice up profitability.

The corporate now anticipates attaining its mid-term revenue targets two years forward of schedule, with projections of working income between £3.6bn and £3.9bn by 2028.

Nonetheless, the fast features might severely restrict additional progress. The common 12-month worth goal is now 13.7% decrease than the present worth. These could also be up to date barely within the coming days, however I wouldn’t count on a lot change. The worth-to-earnings (P/E) ratio is now larger than common at 27, including threat {that a} pullback may very well be imminent.

With the value overvalued and at excessive threat of a correction, I wouldn’t take into account shopping for the inventory now.

There’s additionally the ever-present threat of extra journey disruptions, which might harm the value once more as Covid did. Moreover, any important dip in defence spending might reverse the shares’ upward trajectory.

But, regardless of these dangers, Rolls has one other trick up its sleeve that might nonetheless assist the corporate proceed to develop in 2025.

Nuclear enlargement

Rolls is especially well-positioned to learn from the UK’s plans for nuclear energy. Due to its experience within the improvement of small modular reactors (SMRs), it’s a key contender to help the nuclear technique.

Not like conventional large-scale nuclear crops, SMRs are smaller and quicker to construct, lowering building dangers. They’re additionally extra cost-efficient at round £2bn per unit in comparison with the tens of billions wanted for full-scale crops. Since a lot of the development is finished in manufacturing unit circumstances earlier than meeting on-site, it’s a lot simpler to deploy them.

The UK authorities has already backed Rolls-Royce’s SMR venture with a £210m grant, and the corporate has raised extra non-public funding. If nuclear enlargement accelerates, additional authorities contracts or subsidies might stream to Rolls-Royce, serving to to fund improvement and manufacturing.