Este artículo también está disponible en español.

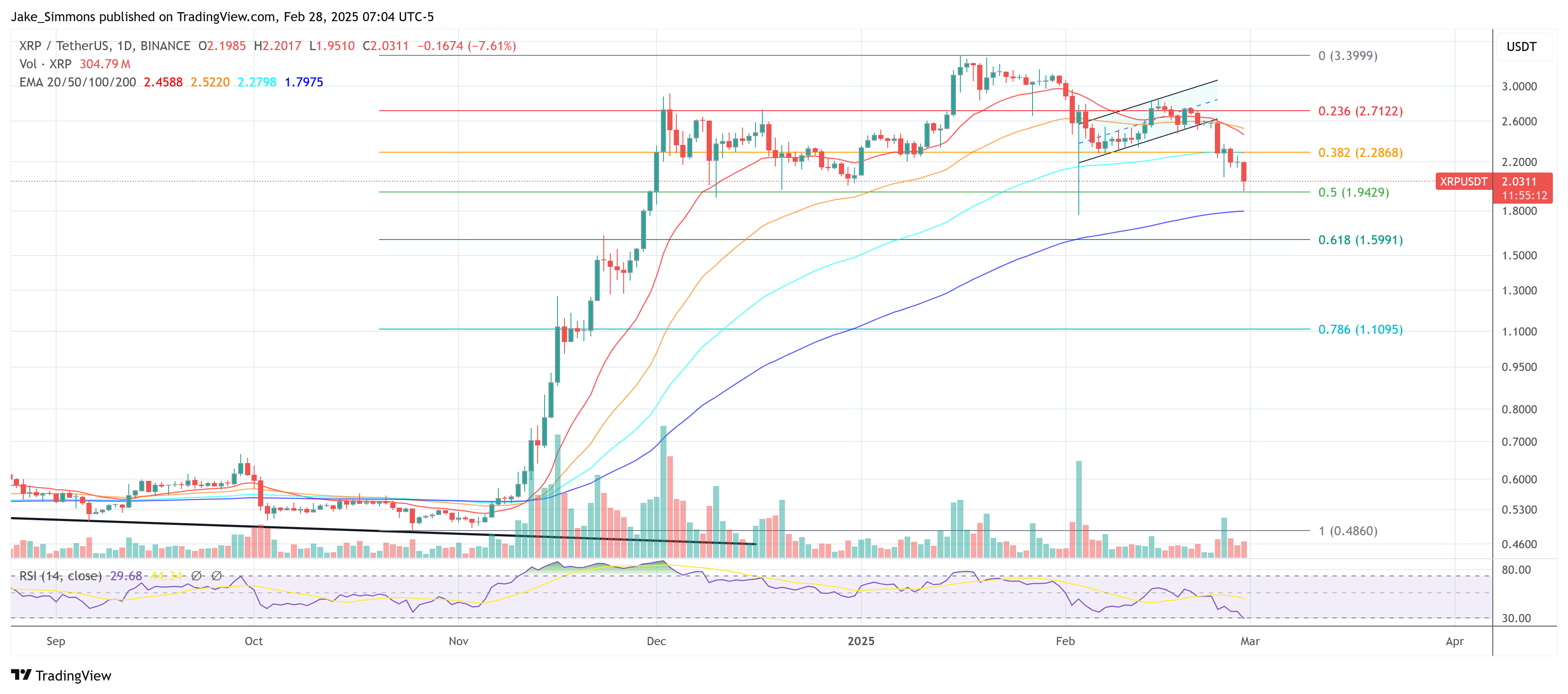

Whereas the XRP value is already down -42% since its peak at $3.40 on January 16, famend technical dealer Josh Olszewicz (@CarpeNoctom) warns that the following leg downward could also be imminent. Sharing his day by day chart evaluation on X, Olszewicz writes, “1D XRP: H&S + bearish kumo breakout watch,” signaling that two important technical developments might push XRP costs decrease within the close to future.

Is XRP Poised To Crash In direction of $1.24?

The point out of an “H&S” refers back to the Head and Shoulders sample, a widely known reversal formation in technical evaluation. The sample sometimes emerges after a considerable upward rally and consists of three successive peaks, with the center peak (the “head”) greater than the flanking peaks (the “shoulders”).

Associated Studying

Within the case of XRP, Olszewicz’s chart means that the central head shaped round $3.40 in mid-January, whereas the shoulders seem like topping out between $2.83–$2.90. Technical analysts pay shut consideration to the “neckline,” which usually runs alongside a key assist stage beneath the peaks. When the worth decisively breaks under this neckline, it’s seen as affirmation that promoting strain has overwhelmed shopping for curiosity, usually resulting in additional draw back.

Olszewicz’s remark additionally highlights the phrase “bearish kumo breakout,” referencing the Ichimoku Cloud system, one other distinguished device for charting and forecasting value momentum. Ichimoku Cloud evaluation initiatives a number of shifting averages ahead on the chart and creates a “cloud” of assist or resistance ranges.

A bearish kumo breakout arises when the worth motion clearly drops under the Ichimoku Cloud and the long run cloud itself shifts in a means that signifies weaker bullish momentum. The core concept is that after an asset’s value slips below the cloud, an extra decline turns into extra doubtless, because the cloud that beforehand acted as assist is not offering a cushion.

From the chart Olszewicz supplied, the present value motion round $2.18 sits simply above a conspicuous assist space within the $2.00 area, which he interprets because the neckline for the Head and Shoulders sample. If that zone offers means, bears might doubtlessly dominate the market, with Fibonacci ranges marked on the chart pointing to a potential first cease close to $1.94, adopted by a good steeper goal.

Associated Studying

The chart seems to focus on a 161.8% Fibonacci extension stage at round $1.24, which might come into play if promoting accelerates. The presence of those Fibonacci ranges doesn’t assure a breakdown to these lows, however notably, a typical breakdown from the h&s sample might spell much more doom.

The revenue goal for the sample is mostly the worth distinction between the pinnacle and the low level of both shoulder. This distinction is then subtracted from the neckline which might place the XRP value even under $1.00.

Regardless of the stark warning about an impending “huge” value crash, it’s essential to notice that Olszewicz’s commentary, “1D XRP: H&S + bearish kumo breakout watch,” ought to be seen as an alert for merchants slightly than an irreversible prediction. Technical setups can fail if bullish momentum returns or if broader market fundamentals shift, however for now the complete crypto market appears pushed by excessive concern.

At press time, XRP traded at $2.03

Featured picture created with DALL.E, chart from TradingView.com