On Tuesday, the US Division of Justice introduced felony fees towards the worldwide crypto trade KuCoin and two of its founders, Chun Gan (also called “Michael”) and Ke Tang (also called “Eric”). The costs, associated to conspiring to function an unlicensed cash transmitting enterprise and violations of the Financial institution Secrecy Act, have stirred considerations amongst customers and traders about the way forward for the Seychelles-based trade, echoing fears harking back to the FTX collapse.

Is KuCoin The Subsequent FTX?

In keeping with the official press launch by the Southern District of New York, the indictment accuses KuCoin and its founders of intentionally failing to implement an ample anti-money laundering (AML) program. This negligence allegedly facilitated using the platform for cash laundering and terrorist financing actions.

Furthermore, the trade is accused of not sustaining mandatory procedures to confirm buyer identities and failing to report any suspicious actions.

Regardless of these critical allegations, CryptoQuant CEO Ki Younger Ju offered a contrasting view, specializing in the trade’s operational and monetary stability. Via an announcement on X, Ju highlighted that, from an on-chain perspective, KuCoin’s Bitcoin (BTC) and Ethereum (ETH) reserves appear unaffected by the surge in withdrawals, primarily by retail customers.

Ju remarked, “On-chain clever, Kucoin is ok. BTC and ETH withdrawals surged, pushed primarily by retail customers, with a small impression on the general reserve. They seem to not commingle clients’ funds and have enough reserves to course of consumer withdrawals.”

This reassurance comes at an important time when the reminiscence of FTX’s downfall, triggered by liquidity points and allegations of misusing buyer funds, nonetheless lingers within the minds of the crypto group. Ju made a transparent distinction between the reserve administration practices of KuCoin and FTX, underscoring the natural nature of KuCoin’s BTC and ETH reserves in distinction to the problematic dealing with of funds by FTX.

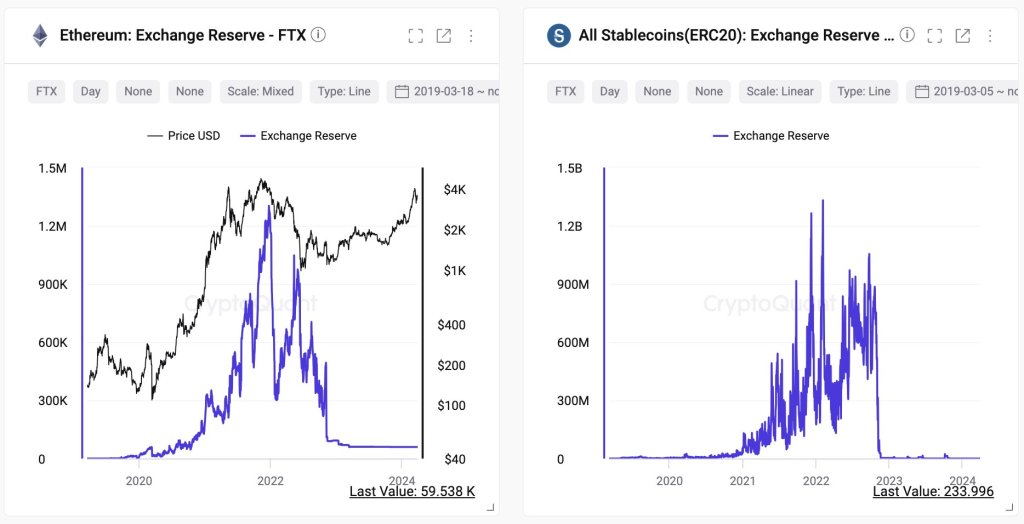

“Kucoin’s BTC and ETH reserves seem natural, in contrast to these of FTX. They don’t commingle clients’ funds,” Ju acknowledged and shared the Bitcoin and Ethereum trade reserves charts by CryptoQuant.

Ju contrasted these charts with the one’s from FTX, noting “Listed below are FTX reserves for comparability. FTX commingled clients’ funds with their funds; you may see a variety of bulk deposits/withdrawals within the charts. It doesn’t look natural.”

As of now, KuCoin maintain 5.949 BTC and 99.358 ETH, in keeping with CryptoQuant’s knowledge. The entire steadiness of KuCoin’s portfolio throughout a number of chains is valued at $4.764 billion, in keeping with Scopescan knowledge.

At press time, the KuCoin token (KCS) traded at $11.42, down -20% for the reason that information broke.

Featured picture from Shutterstock, chart from TradingView.com