Dogecoin has jumped 17% prior to now 24 hours to interrupt previous the $0.21 barrier as on-chain information exhibits a big enhance in quantity for the memecoin.

Dogecoin Beats Market With 17% Rally In The Final Day

A lot of the high cryptocurrencies have seen flat returns within the final 24 hours, however Dogecoin has gone its personal means as the unique meme coin has loved a robust rally.

The beneath chart exhibits what the asset’s efficiency has regarded like throughout the previous few days:

The value of the coin seems to have sharply soared over the previous day | Supply: DOGEUSD on TradingView

On this newest rally, Dogecoin has surged greater than 17% within the final 24 hours and has cleared the $0.21 stage. Among the many high 100 cryptocurrencies by market cap, solely Bitcoin Money (BCH) has registered comparable income in the identical interval.

DOGE nonetheless beats BCH within the 1-week timeframe, nonetheless, because the memecoin has managed returns of greater than 40% on this interval, whereas the Bitcoin hard-fork has seen 33%.

The explanation behind these two belongings particularly seeing a robust efficiency could lie in the truth that Coinbase plans so as to add futures merchandise for them beginning the first of April. Litecoin (LTC) can also be set to see a list on the identical day, however its efficiency has been a lot weaker than the opposite two.

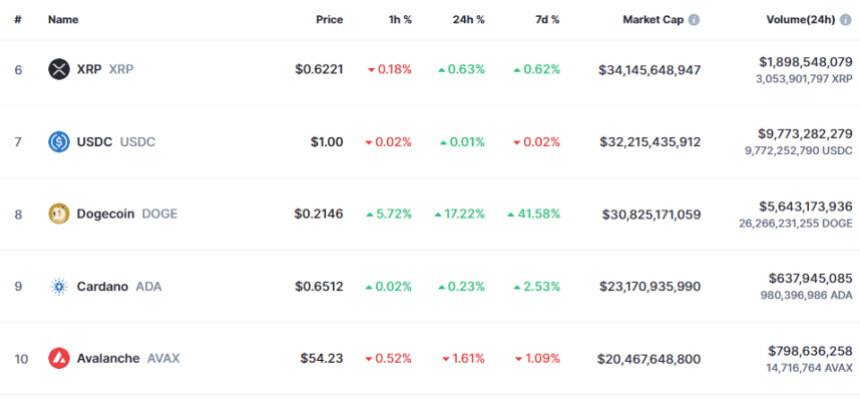

By way of market cap, Dogecoin is at present the eighth-largest coin within the sector, because the desk beneath exhibits:

Seems just like the market cap of the memecoin is slightly below $31 billion in the mean time | Supply: CoinMarketCap

From the desk, it’s obvious that the hole to USD Coin (USDC) in seventh isn’t an excessive amount of proper now, so if Dogecoin can sustain its surge, it’s doable that it might be able to flip the stablecoin.

DOGE Transaction Quantity Has Noticed A Sharp Enhance Just lately

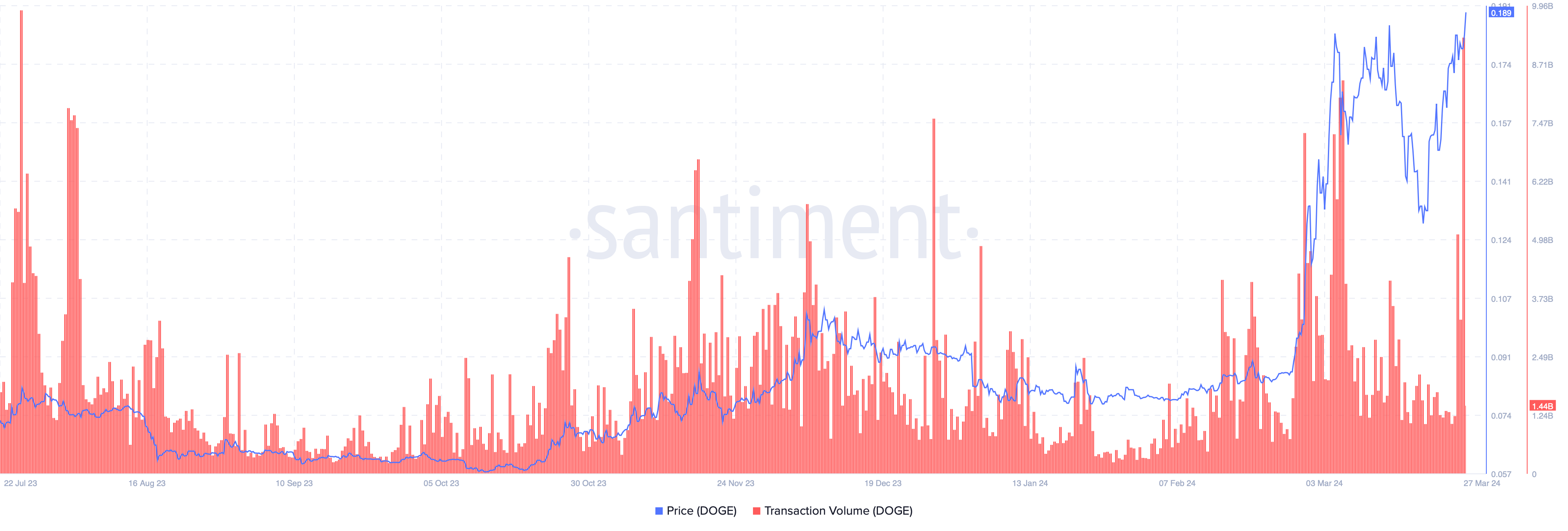

One thing that may affirm that widespread hypothesis round Dogecoin is ripe for a rally at present can be its Transaction Quantity. As a consumer on X identified utilizing information from the on-chain analytics agency Santiment, DOGE’s Transaction Quantity has shot up lately.

The “Transaction Quantity” retains monitor of the overall quantity of tokens (in USD) for a given cryptocurrency that has noticed some motion on the blockchain prior to now 24 hours.

When the worth of this metric is excessive, it signifies that the customers are transacting massive quantities on the community proper now. Such a development implies the buying and selling curiosity across the asset is excessive at present.

Alternatively, low values of the indicator is usually a signal that the final curiosity within the cryptocurrency, each as an asset and a community, is low in the mean time.

Now, here’s a chart that exhibits the development within the Dogecoin Transaction Quantity over the previous yr:

The metric appears to have gone up in latest days | Supply: @trader_kamikaze on X

As is seen within the chart, the Dogecoin Transaction Quantity has skilled fairly a lift lately, and what has accompanied this rise has been the newest rally.

A rising quantity can usually be a constructive signal for the sustainability of any rally, because it signifies that curiosity within the asset goes up, and thus, extra gas is doubtlessly coming in.

One thing to remember, although, is that promoting and shopping for alike have an effect on this indicator, so a mass selloff would additionally register as a spike within the metric. Thus, whereas excessive volumes are often a requirement for rallies to proceed (as with out curiosity, the run can simply die down), they alone can’t predict an extra rise, as the character of this exercise may be onerous to establish.

Featured picture from Kanchanara on Unsplash.com, Santiment.internet, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal danger.